Recent News

First Dakota National Bank marks 150th anniversary with family focused on its future

Posted in PFBA, Success Stories | August 22, 2022

Aug. 22, 2022

This paid piece is sponsored by the Prairie Family Business Association.

Less than one-half of 1 percent of businesses reach their century anniversary.

Even fewer can claim 150 years in business – a milestone First Dakota National Bank is celebrating and the result of early pioneers along with modern family leadership combining to serve a growing state.

“My philosophy is pretty simple: Do the right things and then do things right,” said Larry Ness, who took over the bank in 1983 and has led it ever since.

“Forbes named us the top community bank in South Dakota a few weeks ago, and it’s all because of our people.”

Pioneer spirit

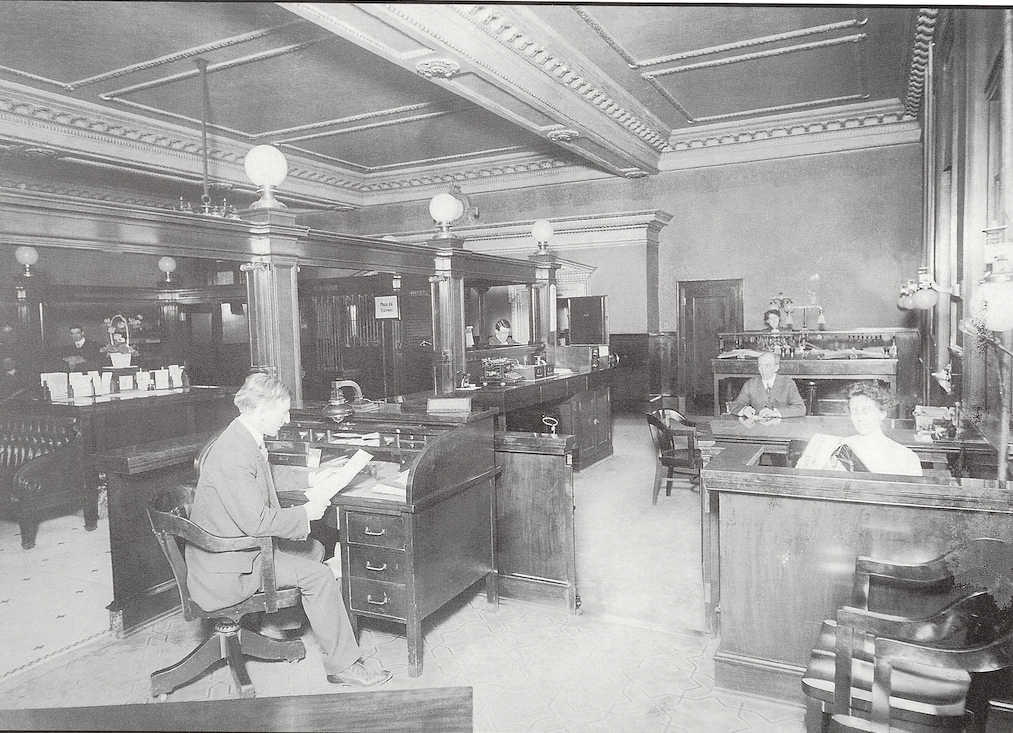

The first people who helped build First Dakota National Bank were early settlers of Yankton, where it’s still headquartered.

In 1872, it became the first fully chartered bank in the Dakota Territory. Moses Armstrong, the original president and cashier, was joined by six other original stockholders.

“Yankton had some interesting people in it – all entrepreneurs – and this was the last of the frontier at the time,” Ness said. “Moving up the river, nothing had been developed, so Yankton was a center of activity.”

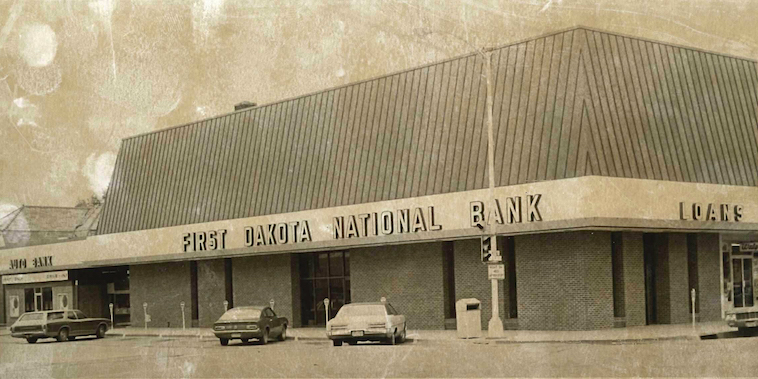

“The Danforth family purchased it from the original shareholders at least as far back as the early 20th century,” Ness said. It merged with another Yankton bank in 1912 and stayed in the Danforth and Gross families until the 1980s.

Ness had grown up around the industry. His grandfather, a farmer who immigrated to northeast South Dakota from Norway, helped start the first bank in Sinai, which is west of Brookings. His mother and father later served on the bank’s board of directors.

When Ness moved to Yankton from Volga to help lead First Dakota National Bank, a dire future was predicted by some.

“There’s an article from the Minneapolis Star Tribune that I saved, and it said that First Dakota National Bank would fail by August of 1983,” he said. “I arrived in April with the hope of straightening it out, and the rest is history.”

The bank had struggled lending money to “Main Street businesses that didn’t turn out,” Ness continued. “It put a lot of pressure on the bank. And I came here and put some money in and got some other locals to put some money in, and that’s what kept us going.”

Ness previously had been a national bank examiner – he had examined First Dakota since 1970 – and “I didn’t think the problems were as severe,” he said. “So I got going and hired new people, and we’ve been going strong ever since.”

He purchased the bank from the families, who were ready to get out of the business, and “they were so good to me,” he said. “I came in wanting to make a lot of changes, which doesn’t make everybody happy. And I can’t thank them enough for the friendship and seeing the future from my eyes today. They sold it to me, and here I am today.”

Multigenerational business

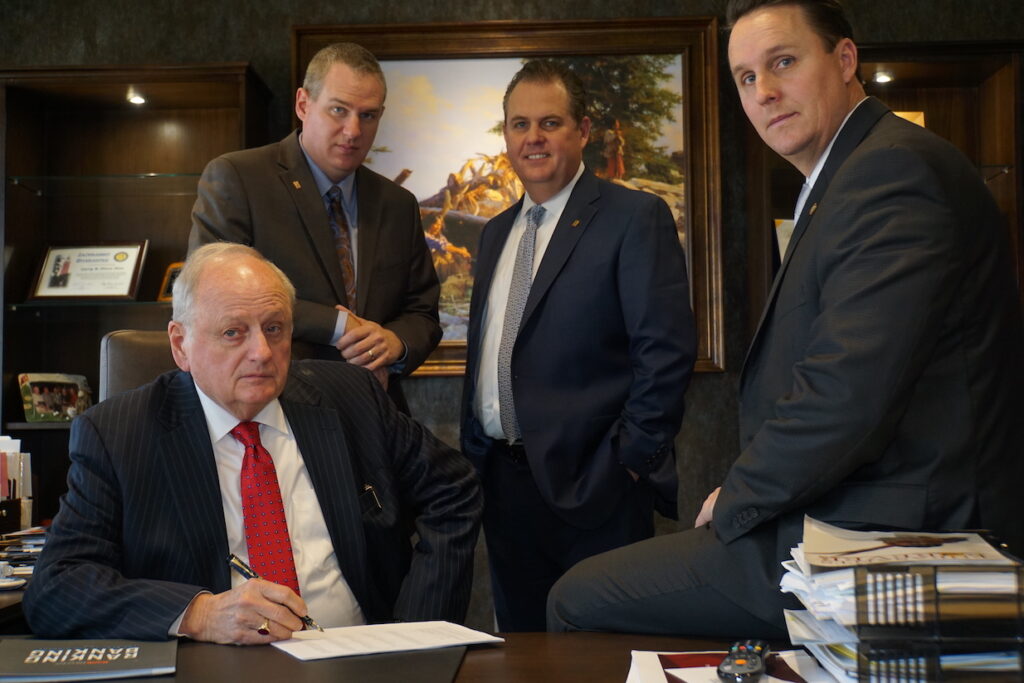

First Dakota National Bank today has a balance sheet of $2.6 billion. Add in its brokerage and trust departments and assets under management total $4 billion.

There are 370 employees, including Ness’s three sons: Michael, Aaron and Rob.

With each, he encouraged them to go to college and then work elsewhere before considering a position at the bank.

“And they did – one worked for a bank in Texas, one worked for a bank in Lincoln, Nebraska, and the third became a national bank examiner, which is what I had done, and they all got very good backgrounds in banking, and when the time came right, they came trickling in here,” Ness said.

Michael, who joined the bank from Nebraska, began its entry into the Sioux Falls market, “and now we’ve got over $1 billion under management in Sioux Falls, so that’s been a good move for us,” Ness said.

Aaron serves as market manager for Yankton in charge of community lending, and Rob serves as the bank’s chief financial officer.

“One of the really good things is those boys talk to each other every day,” Ness said. “They don’t even tell me what they’re talking about. We’re really happy about that, and they’re happy for each other. If one succeeds, the other two are happy. Their mother raised them well.”

Michael Ness jokes his first job at the bank was as vice president of shredding – using an old table saw in the basement on nights and weekends, shredding confidential papers while he was a high school student. He then progressed into working in deposit services for a summer in the pre-digital banking era, which meant a lot of time on the phone.

“And then, I started working as a teller and did that throughout parts of my senior year of high school and summers,” he said. “I highly recommend anyone who wants to get into banking start out in deposit services or the teller line to learn the nuts and bolts of banking from the ground up.”

His career goals initially didn’t include banking, though. While at the University of Nebraska-Lincoln, he became part-owner of a bar and did that for a number of years, “learning valuable skills for owning a small business and running one, which helped me as a banker as I got into banking,” he said.

That happened as he was ready to start a family, and he joined a community bank in Lincoln for two years before his father reached out with an offer.

“He said they were thinking of going into the Sioux Falls market and asked if I had any interest in moving up,” Ness said. “My wife was from Lincoln and had gone to college in California, so I asked her to try Sioux Falls for a year, and if she didn’t like it, we’d figure something else out, and we’re here 20 years later, and she loves it.”

The Sioux Falls market also has been a good fit for First Dakota National Bank.

“We started from the ground up with zero dollars, and now we’ve got about 115 employees in Sioux Falls and four locations, and I don’t see us stopping any time soon.”

Working with family, “I’m fortunate my brothers and I get along well,” he said. “I don’t think there’s any animosity. We all do different things in the bank, and we’re all on the board. We’ve found our niches, and that seems to work well and has served us well.”

Preparing for the future

Larry Ness recognized early in his career the importance a strong family business foundation would have for the bank. He became involved in the first years of the Prairie Family Business Association and found it “very educational,” he said.

“I need to get my boys more involved because it would be good for them and good for the business,” he said. “I always found talking with other people who had ideas I never thought of, whether in banking or not, was very beneficial.”

Michael Ness also has attended several conferences and sees his generation becoming more involved in the organization.

“We plan to become more active,” he said. “I’ve always found them very beneficial.”

The bank’s longevity is a point of pride for all of South Dakota, said Stephanie Larscheid, executive director of the Prairie Family Business Association.

“It’s just incredible to be in business 150 years,” she said.

“First Dakota National Bank is a very rare story of family business longevity and right at the top of our most long-established members. The work Larry and his team have done to bring this bank into the future is so admirable and something many family members can learn from. We couldn’t be happier to congratulate them on this milestone.”

Looking back on the past 40 years, “There’s nothing magical about what I’ve done,” he said. “Have I made mistakes? You bet. Lots of them. And I’ll probably make more by the end of the day. But if we do something that doesn’t work, we change it and move on and go to something else we think will work. We’ve had such a great team of people. It’s just been great fun.”

This milestone year also marks a personal and professional one for Ness, who is 77. He has decided to retire at the end of the year as CEO.

He’ll be succeeded by longtime executive Rob Stephenson, who currently serves as president.

“I have stayed out of his way for probably three years now and let him do his thing, and he’s just a brilliant person and works twice as hard as I ever thought of working,” Ness said. “He’s a good choice, and I owe it to him to let him do his own thing. When I’m out of here, he’s got it by the horns.”

Ness and his wife, Diane, have been transitioning ownership of the bank for 10-plus years to their sons, who are now the majority owners.

He also plans to continue serving on the board as long as his health allows.

“I’m really interested in helping nurture our employees and giving people opportunities to grow,” he said. “We make an effort to meet the needs of our communities and employees, and if you can do both, you’ve got something going.”

The second generation also plans to take a unique approach to its board service, Michael Ness said.

“We decided as a family several years ago that Rob was our choice to succeed my dad as CEO, and we’ve all been happy with that decision,” he said. “And we’ll do things a little different at the board level with a rolling schedule of who the chair is going forward. My dad will stay as a director for the foreseeable future but will give up chairmanship sometime soon, and we’ll take two- to three-year terms between the three of us.”

While there have been opportunities over the years to get out of the family business, Larry Ness never really considered it.

“I owe it to our community, the Yankton community especially, who was so supportive of me when I came here to get it on the right track,” he said.

“I couldn’t bear to sell it to somebody with the idea I wouldn’t know what would happen. We support the communities we serve, and we’re in some smaller towns where we’re one of the bigger things they’ve got going, and we want to keep it that way.”

The Prairie Family Business Association helps family businesses thrive through generations by providing a resource network for family business success. The association is a key outreach center of the University of South Dakota Beacom School of Business.