3 Family Businesses Honored with Awards from Prairie Family Business Association

Recent News

*Part two of a series of stories about Prairie Family Business Association founding members in celebration of our 30th anniversary.

Nelson & Nelson CPAS knows something about longevity.

As the state’s oldest homegrown accounting firm, founded by James Nelson in 1923, it’s now in its fourth generation and includes clients from 32 states and multiple countries.

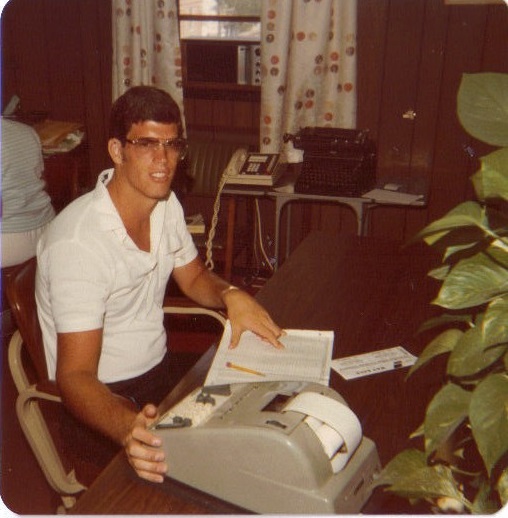

James Nelson in 1962

So maybe it’s fitting that the family behind the firm also helped start what became the Prairie Family Business Association, which marks its 30-year anniversary this year.

Chuck Nelson, third-generation owner, and his father, Wesley, were founding members of the association. Wesley has been semi-retired for a few years but still spends time in the office, and Chuck’s daughter, Jill, joined the firm in 2013.

We sat down with the three generations of accounting leaders for an update on their firm and a look back at how they helped bring other families together in the Prairie Family Business Association.

Let’s start with a little history. How did your family become connected to the original Prairie Family Business Association?

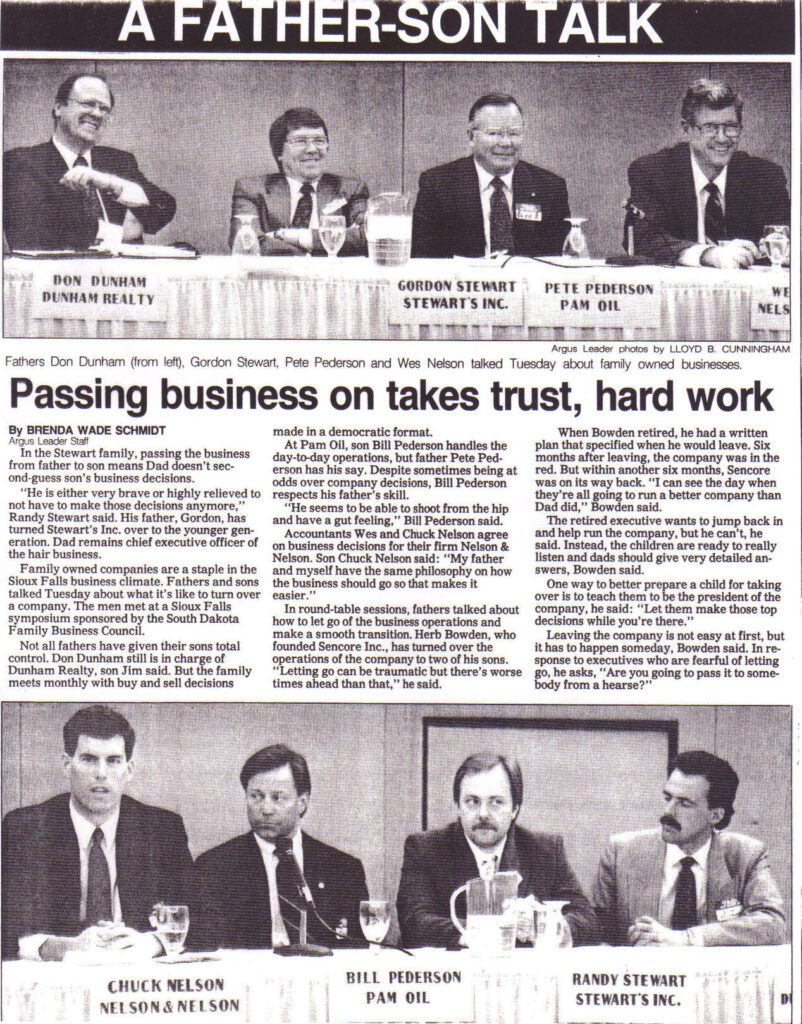

Chuck Nelson: I think it was Bill Baker at The First National Bank, which was where we banked, who got us going with it. At that time, it was called the Sons of Bosses, and later the South Dakota Family Business Council, and we knew many of the original families. It started with an evening dinner and guest speaker every month or so, and you had to be at least into your second generation as a business.

Chuck Nelson in 1983

Wesley Nelson: The main thing I remember was the meetings would start out business-like and later on it got to be a fun evening. Back then, it was very uncommon even for a second generation to take over a business and keep it going. I realized in transitioning with Chuck how important that was because not many families survive into a third or fourth generation. There can be a lot of pressure in this business, and my father had talked to me about how he didn’t want me to feel like I had to come into the business. Having him express that took some of the pressure off.

Wesley Nelson

What were some of your early memories of the association?

Chuck Nelson: One of the first speakers once broke us into three groups depending on if you were the oldest or youngest child in the family or somewhere in between. Only children went with oldest children. Then, we were asked to plan a hypothetical party. No other direction was given. And if you were in the oldest-child group, which I was, the party was very organized and detailed. The youngest group was a free-for-all. Everybody could come, no rules. And then the speaker explained the family dynamics involved, and I remember that being a lot of fun.

By the time the association had transitioned to USD, I think we had a roster of up to 50 families and you’d develop camaraderie within the group because you’re in the same situation as part of a family business. It’s almost like how you develop camaraderie serving in the military with someone. I think of Kevin Nyberg at Ace Hardware, who I got to know through the association, and they’re just unique relationships to have friends who have gone through similar situations. There’s comfort in being able to talk to someone along those lines.

What are some ways the association has served as a resource for you, including for Jill when she joined the business?

Jill Nelson: I joined the association in 2015 as part of an Affinity Peer Group, which is all next-generation family business members. We get together every other month and talk about what we’re going through with the business, other family members and working through the transition process. It’s been nice to have other people to talk with who are going through or have dealt with the same issues because a lot of other people our age aren’t going through the same things we are or have the same pressures at work as we do.

Chuck Nelson: The annual conference falls during tax season so that can be challenging, but we have done some of the webinars, and there have been some we’ve gone to that other members have hosted.

Catch us up on Nelson & Nelson CPAs. What’s driving activity at your firm?

Chuck Nelson: The firm has continued to grow, and we are in a great position of looking for additional staff. Additionally, we have been able to be more selective on the new business that we are accepting. We have also tried to specialize in certain areas. Two of the areas that we have seen an increase is business in the trust and estate area and nonprofits. Those areas have very unique issues. We have also found that many companies have chosen to use us as their accounting department. They have found that it’s more efficient and adds more value than having an internal CFO or accountant.

We have 32 people on staff, and even though they don’t have ownership at this time, we run it as a family business and do activities together within the office and try to create a family atmosphere.

What would you say to other families that maybe haven’t connected yet with the Prairie Family Business Association?

Chuck Nelson: There’s just a lot of resources there. When you’re running a business, it’s easy to keep doing things how you’ve always done them, and this allows you to bounce ideas off of others and hear about what they’ve done. It can make you more productive, and it’s definitely beneficial. A lot of times you run into problems, and you can look something up to help address them, but this is a resource that helps you manage your business, learn what you don’t know and may lead you into avoiding a problem in the first place.