Preview a ‘taste’ of family business at one-of-a-kind dinner

Recent News

Fourth-generation bank embraces flexibility, family’s values during pandemic

Posted in PFBA, Success Stories | November 3, 2020

At 73, Van Fishback has been around his family’s bank since he was a teenager.

He began full time in 1972 and now serves as board chair of Fishback Financial Corp., the holding company of First Bank & Trust, a role that finds him stopping in the bank most days while balancing his time serving community organizations.

On one hand, you might say nothing that happened in all those decades could prepare even a banking veteran like Fishback for the events of 2020.

On the other hand, you might come to realize that everything that happened in all those decades at the family-owned bank is what helped the company navigate through this year.

“This is the first time in my life I’ve had anything close to a COVID experience,” he said. “And I think it’s our responsibility as community banks to take care of our respective communities. Our No. 1 goal is to make sure we assist as many people through COVID as possible.”

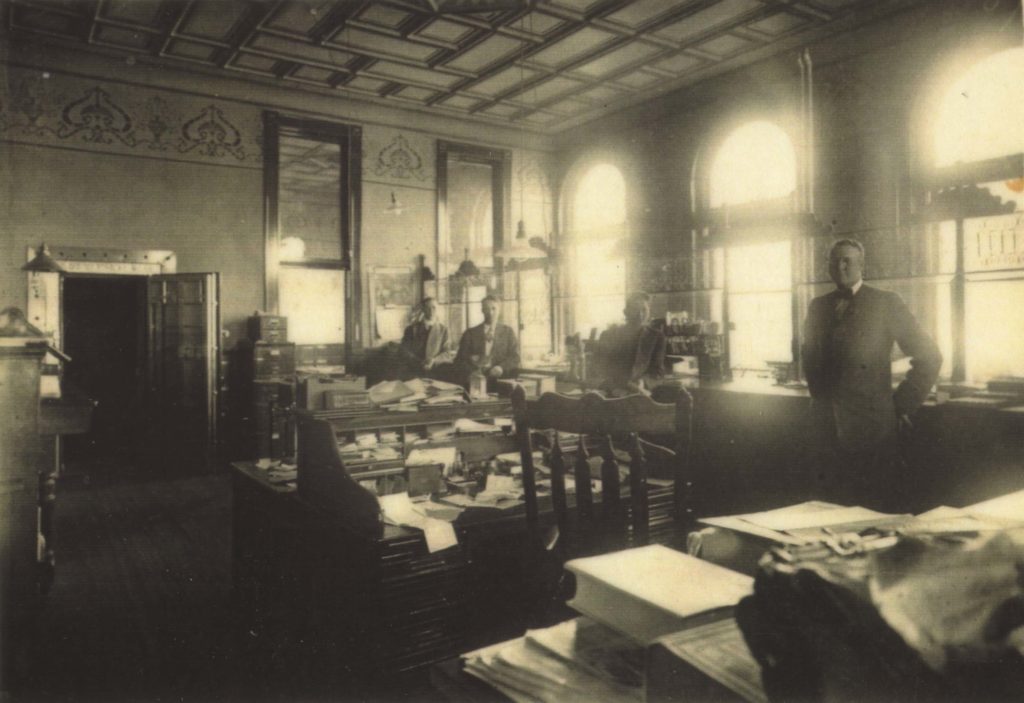

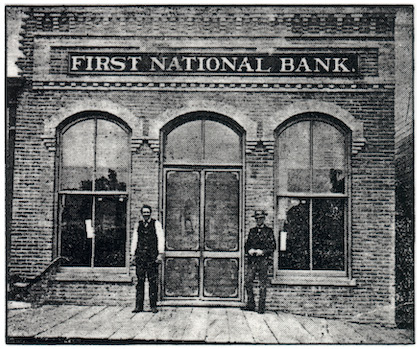

First Bank & Trust was formed in 1883. Horace Fishback Sr. and his uncle, Bert Olds, took the railroad as far west as it went, ended up in Brookings and started a general store that became a community hall.

It became a center for early civic engagement, and the family realized there was a need for check cashing. A counter in the back of the shop evolved into a bank, originally called Security National Bank. It later became First National Bank in Brookings before transitioning to First Bank & Trust in the early 2000s.

Van Fishback is the third generation, along with his brother Bob. Tom, Van’s son, and John, Bob’s son, are the fourth generation working in the bank, although others are still involved more indirectly. The bank also has an employee ownership program.

Van and Bob Fishback

This year, though, will be remembered as historic for many reasons. In addition to navigating the pandemic, the bank recently completed merging its two largest charters into one, setting the stage for a more streamlined organization.

“It enhances our ability to deliver value for our customers,” Van Fishback said.

The bank’s customers have faced a multitude of needs this year, from businesses in need of help with SBA programs to new homeowners working through financing.

“At times, we had people in the organization who spent literally 24 hours a day using whatever flat space they could find at home to get applicants through the SBA,” said Tom Fishback, the bank’s Brookings market president.

“All year, it’s been a full team effort. You learn in a hurry who steps up, and we saw that time after time.”

More than half the bank’s 700-person staff still is working most of the time from home, and the rest largely use a hybrid approach.

“First Bank & Trust is such a strong example of an organization that’s put its culture to work for the betterment of all involved this year,” said Stephanie Larscheid, executive director of the Prairie Family Business Association. “Their approach is definitely one worth emulating.”

Here are four key ways this longtime bank has found success managing through its unprecedented adjustments.

Reassure to help ease fear

One of the first actions the bank took was to let its team members know their jobs would be safe.

“We have not put anyone on furlough or released them,” Van Fishback said.

He had sent a similar message more than a decade ago during the financial crisis.

“And we let everyone know right away that again wasn’t an option, and we’re all going to fight through it together,” Tom Fishback said.

“It’s important people work on their work and not wonder about what their jobs are going to do. It’s part of culture we’re not going to downsize. And in a tight labor market, the more you can provide benefits and assurances the better you’re going to be in the long run.”

Listen to their lives

First Bank & Trust took a flexible approach with allowing employees to balance other priorities in their lives with work before the pandemic, and that carried over while most worked from home.

“We prioritize thinking about the entire employee, whether it’s working in an office or in the bank or at home – the various hats our employees put on, from being a parent to being a teacher to running a household,” Tom Fishback said. “We think about everything they have to do during the day and concentrate on them as an overall person.”

In Brookings, that includes offering child care through the bank’s child care center, which never closed.

“It’s a very strong service for our employees,” Van Fishback said. “And we’ve taken all kinds of steps to ensure protection.”

Stay connected daily

Many First Bank & Trust teams are doing frequent virtual meetings, including some daily check-ins.

“When my father and uncle got into banking, I doubt they would ever dream we’d be doing this, but it’s working to our advantage,” Tom Fishback said. “It will happen until we’re able to come back.”

No departments have spent time all together face-to-face since the spring, so the virtual sessions provide teams the chance to “have a cup of coffee, talk about the projects you’re working on and transition like you were coming into the bank from home to work life,” he continued.

“And we continue to have staff and department meetings carry on as usual. The fact we’re able to retain some normalcy is really important as we still have normal banking functions to work on.”

Give back, get through together

Employees also were encouraged to buy gift cards supporting local businesses early in the pandemic and were reimbursed by the bank. The cards were distributed throughout the year for employee appreciation.

“We just wanted to do as much as we can for our local restaurants and businesses,” Tom Fishback said. “It was a small token, and we just thought it was very well received. Employees liked doing it. It made a big difference.”

It has been humbling to see employees and customers alike rally through all of it, Van Fishback added.

“Nothing of this magnitude can be called a success, but we have gotten along pretty well,” he said.

“I, as an observer for the last several months, have communicated with the bank and just say we need to take care of ourselves and make sure our health is good and our energy is good. This will be done when it’s done, and in the meantime we’re going to do everything we possibly can to protect our people both inside and outside the walls of our bank.”

Want to hear more from the banking family? Tom Fishback sat down with Prairie Family Business Association executive director Stephanie Larscheid, and you can view the conversation below.